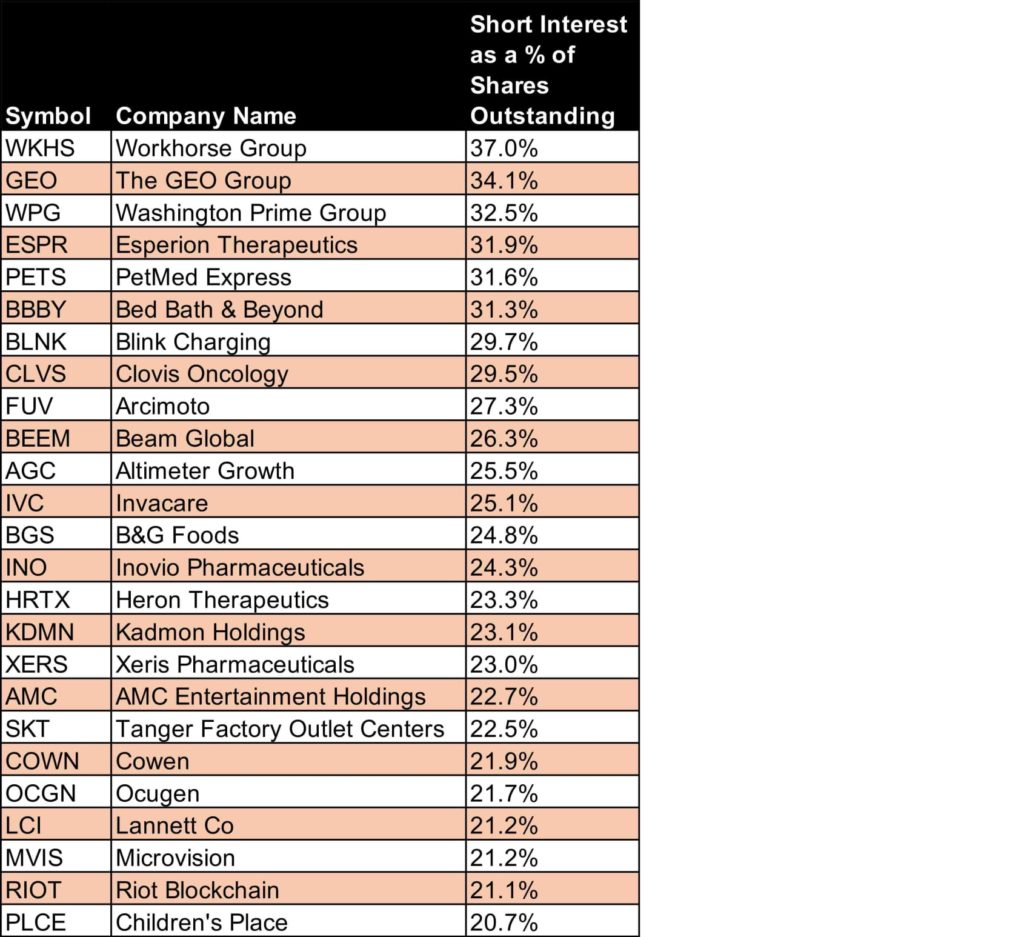

The Next GameStop? 25 Stocks With High Short Interest

Source: Kiplinger | by: Dan Burrows June 11, 2021

A recent trading frenzy around heavily shorted stocks has targeted names such as these. But beware: The music could stop at any moment.

Meme stocks are back in the headlines in a big way these days, with shares in everything from GameStop (GME, $220.39) to AMC Entertainment (AMC, $42.81) to Clover Health Investments (CLOV, $14.34) lighting up Wall Street message boards and CNBC’s news crawler.

And that has sparked renewed interest in companies with high short interest.

Sometimes, Wall Street bets heavily against a stock (by “shorting” it). But those bears sometimes get it wrong, and when they do, it can trigger an effect called a “short squeeze.” You can learn more about how short squeezes work here, but in brief, it’s a phenomenon that occurs when buying in a stock forces bears to exit their negative bets, which they can only do by purchasing stock, fueling a virtuous cycle that can send shares aggressively higher.

For instance, AMC Entertainment, fresh off a $587 million new-stock sale, more than doubled intraday at the start of June, and has bounced between a high of $72.62 and a low of $28.53 in just the past couple of weeks.

It’s not alone. GameStop – sort of the Original Gangster of the recent meme stock craze – shot up by more than 35% during the first few days of June before tumbling more than 27% in a single session on June 10. And Clover Health? It has been a volatility machine. Chatter on social media platforms helped CLOV more than triple in value over just two days. The trade then abruptly reversed course, with shares off by more than a third since their June 8 close.

The bottom line is that ever since the bros of r/WallStreetBets (WSB) began a campaign to crush hedge funds shorting GME by setting off a short squeeze (while making hefty paper profits to boot), every stock with high short interest has become chum.

To get a sense of where the next shark bait might come from, we’ve put together a list of the 25 stocks with the highest short interest – or percentage of shares outstanding sold short – trading on major U.S. exchanges, according to the latest data available from YCharts.

Be forewarned that this list is for informational purposes only. Going long on a stock with high short interest thinking you’re going to get rich off panic-buying by short sellers is an exceedingly dangerous idea. Heck, it’s at least as risky as shorting stocks with high short interest in the first place.

When it comes to playing around with high short interest stocks, unless you are uncommonly lucky, let’s just say the risks generally greatly outweigh the rewards.

Data courtesy of YCharts